The G. Halsey Wickser, Loan Agent Diaries

Table of ContentsRumored Buzz on G. Halsey Wickser, Loan Agent10 Easy Facts About G. Halsey Wickser, Loan Agent DescribedThe Buzz on G. Halsey Wickser, Loan Agent10 Easy Facts About G. Halsey Wickser, Loan Agent ExplainedThe 20-Second Trick For G. Halsey Wickser, Loan Agent

The Support from a mortgage broker does not finish when your mortgage is secured. They give continuous help, helping you with any concerns or concerns that occur during the life of your lending - california mortgage brokers. This follow-up assistance ensures that you remain pleased with your mortgage and can make educated decisions if your financial scenario changesBecause they collaborate with numerous lending institutions, brokers can locate a lending product that matches your distinct monetary scenario, even if you have been turned down by a financial institution. This adaptability can be the key to opening your imagine homeownership. Selecting to function with a home loan consultant can change your home-buying trip, making it smoother, faster, and extra financially valuable.

Locating the right home for on your own and figuring out your budget can be very stressful, time, and money-consuming - california loan officer. It asks a whole lot from you, diminishing your energy as this task can be a task. (https://g-halsey-wickser-loan-agent.jimdosite.com/) A person who serves as an intermediary in between a borrower an individual seeking a home mortgage or home mortgage and a lending institution normally a financial institution or lending institution

What Does G. Halsey Wickser, Loan Agent Do?

Their high level of experience to the table, which can be crucial in aiding you make educated decisions and inevitably attain effective home financing. With rates of interest fluctuating and the ever-evolving market, having actually somebody completely tuned in to its ongoings would certainly make your mortgage-seeking procedure a lot easier, easing you from browsing the struggles of loading out documentation and executing stacks of research.

This allows them supply experienced assistance on the finest time to protect a home mortgage. Due to their experience, they also have actually established links with a vast network of lending institutions, ranging from major financial institutions to specialized home loan companies.

With their sector knowledge and capability to discuss effectively, home loan brokers play an essential duty in securing the finest home loan offers for their customers. By maintaining connections with a diverse network of lenders, home loan brokers access to a number of home mortgage alternatives. Their heightened experience, clarified above, can supply invaluable information.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

They have the skills and methods to persuade loan providers to provide better terms. This might include reduced rate of interest, minimized closing prices, and even much more flexible settlement timetables (Mortgage Broker Glendale CA). A well-prepared home mortgage broker can provide your application and monetary account in a manner that allures to lenders, increasing your possibilities of a successful negotiation

This benefit is typically a pleasant surprise for numerous buyers, as it allows them to take advantage of the knowledge and sources of a mortgage broker without stressing over incurring extra costs. When a customer safeguards a mortgage with a broker, the lender makes up the broker with a commission. This compensation is a percentage of the financing amount and is often based upon variables such as the rate of interest and the kind of funding.

Home mortgage brokers stand out in recognizing these differences and functioning with lenders to find a mortgage that matches each customer's particular needs. This personalized method can make all the difference in your home-buying journey. By functioning closely with you, your mortgage broker can make certain that your loan terms and conditions line up with your monetary objectives and abilities.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

Customized mortgage remedies are the key to a successful and lasting homeownership experience, and home loan brokers are the specialists who can make it take place. Hiring a home mortgage broker to function together with you may cause quick finance authorizations. By utilizing their knowledge in this area, brokers can help you prevent possible mistakes that usually cause hold-ups in lending approval, causing a quicker and more reliable course to safeguarding your home funding.

When it pertains to buying a home, browsing the world of home mortgages can be overwhelming. With many choices readily available, it can be testing to discover the appropriate funding for your demands. This is where a can be a beneficial resource. Mortgage brokers act as intermediaries between you and prospective loan providers, assisting you locate the most effective mortgage offer tailored to your certain circumstance.

Brokers are fluent in the ins and outs of the home mortgage sector and can supply beneficial understandings that can help you make informed choices. Rather of being restricted to the mortgage items used by a single loan provider, home loan brokers have access to a wide network of lending institutions. This suggests they can go shopping around in your place to discover the most effective funding choices readily available, potentially conserving you money and time.

This accessibility to numerous loan providers gives you an affordable advantage when it comes to protecting a positive home loan. Searching for the best home mortgage can be a time-consuming process. By working with a home mortgage broker, you can conserve time and effort by allowing them manage the research study and documents involved in searching for and securing a finance.

G. Halsey Wickser, Loan Agent Fundamentals Explained

Unlike a bank funding policeman that might be juggling multiple customers, a mortgage broker can supply you with personalized service customized to your specific requirements. They can take the time to recognize your financial circumstance and objectives, providing customized options that line up with your details requirements. Home loan brokers are experienced negotiators that can aid you protect the finest feasible terms on your finance.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Michelle Pfeiffer Then & Now!

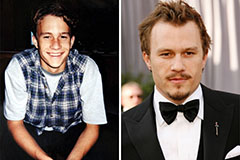

Michelle Pfeiffer Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!